Greta, the Dalai Lama, scientists discuss urgency for natural climate solutions; now’s the time to develop, implement and scale, clean, sustainable, circular solutions; here’s how…

“Investing in profitable solutions is fundamental to building a circular and sustainable economy,” says Daniel Robin, founder and managing part of In3 Capital Group, “and the need for zero waste and nature-inspired strategies has never been more pressing.”

At a recent webinar attended by Daniel and thousands of others, His Holiness the Dalai Lama, climate activist Greta Thunberg, and leading world scientists discussed evidence that climate change is quickening now, with an exploration of the steps for addressing these urgent challenges. Their conversation about Climate Emergency Feedback Loops revealed the science demonstrating that we do not have much time to act before the damage is “irreversible.”

The imperative to sequester carbon, focus on topsoil rehabilitation, massive tree plantations and other methods to help reverse climate change have become even more time sensitive. Working with nature is this way presents vast opportunities for drawing down atmospheric carbon into living plants, known as “natural climate solutions.” It also happens to be profitable, when done right.

“It’s about scale and timing,” states Daniel Robin, founder and managing partner of In3 Capital Group. “We have to reach scale, and do it quickly.”

Daniel observed that, despite popular belief, “climate change is not future, it is here. We can make this shift to a more sustainable economy and slow down the emissions while simultaneously reaching sufficient scale to draw the atmospheric carbon down into soils.” Daniel points out that “Reducing our carbon footprint is always the first line of mitigating climate change, but done properly it also happens to be quite profitable.”

Providing a novel “next generation” approach to project finance, In3 Capital Group partners to create a continuum of funding to accelerate the development and deployment of natural climate solutions worldwide. Focusing on mid-market projects with social and/or environmental benefitsandsolutions with the greatest potential for making enough of a difference while there is still time, In3 mobilizes private investments – equity and debt capital – giving preferencetosome 30 sectors.

Current direct investment priorities include utility-scale solar/PV, storage, wind power assets, waste-to-value (including pyrolysis/gasification or AD/biogas), regenerative agriculture, agroforestry, commercial “green” real estate, affordable housing, smart communities, energy and water efficiency, and various pathways to restore healthy soils, recover resources, and use waste to generate renewable energy and/or industrial materials.

In3 can reduce financing costs and improve terms so that capital becomes more accessible and affordable, delivered faster and more reliably, and for longer loan repayment periods to developers of mid-market projects, their sponsors, service providers, governments and other stakeholders. The goal is to expedite impact projects to come online without compromising quality or performance.

“Together we can develop, implement and scale, clean, sustainable, circular solutions.”

In their discussions, Greta and HH The Dalia Lama, urge us to Protect, Restore, Fund – to fund those things that restore nature and to stop funding those that destroy it.

Many of us take our inspiration from nature. “Nature is a tool we can use to repair our broken climate.” Daniel concurs, saying there is a dire need to invest in projects that support natural or biology-based methods of pulling carbon out of the air such as blue carbon farming (mangroves, kelp and seagrass farms), forest restoration, and regenerative food systems.

“Through mobilization of private financing and mitigation of credit risks for impact projects, we support sustainable economic growth,” says Daniel. “With scale and volume of completed projects, we may eventually begin to mitigate, and then reverse climate change. Such projects also help countless people and their families to thrive in the face of adversity.”

Daniel stresses that the time is now to organize and fund natural climate solutions and advises not to overthink the situation at hand. Act now, analyze later.

“Problems get our attention, but when a solution’s dangling right in front of us, we don’t always see it. We have vast, quite profitable and proven solutions to many of our sustainability challenges. There has never been a better time to express and deploy whatever you can bring that will deliver social and/or environmental benefit.”

“Now is the time to scale, without hesitation.”

Winston Churchill famously once said: “You can count on the Americans to do the right thing … after they have tried everything else.” Daniel notes that now is the perfect time to get this right, to scale these well-proven solutions to sustainability challenges. Hesitate much more and we’re lost.

For the longest time it seemed that climate change was going to have an impact in some far-off imagined future – perhaps a hundred years or more. Strong evidence now that we really do need to mobilize – no time to be a passenger or get distracted by striving for the perfect plan when a reasonably careful and profitable one might be just as financeable.

Mission-aligned investing or “Impact Investing” as In3 Capital Group defines it, supports these and many other solutions, and abides in a vision of peace and prosperity, energy, food, water, housing security for all. We are building on the good work of our clients to create a cleaner, better, brighter, healthier future.

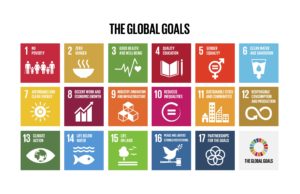

In3’s Investment Strategy and Impact Capital Focus aim to help achieve the UN Sustainable Development Goals(SDGs), where private capital, if wisely and properly deployed, has the potential to get us there faster.

In3 assists with raising “affinity capital” where core values and beliefs are shared with investment partners and help clients and their partners to profit with meaning.

“Impact Investments grow regional economies, strengthen trade partners, create jobs and change lives – and can create positive impact beyond financial return.”

In3 ‘next gen’ approach to project finance delivers funding to developers seeking up to 100% of their project’s budget from a single Family Office under its Capital Guarantee Program, and can expedite project funding for $25 million or more.

In3 can help fund, develop, engineer, procure, build or manage projects. The available capital is not organized as a fund. It is a Family Office finance facility, which means it is much more flexible.

Inspire, Innovate, Invest

With a proven track record of over 25 years, In3’s capital gives preference to project with positive social and/or environmental impacts, and often achieve twin goals of poverty reduction and improved health & security as well as natural ecosystem protection or restoration.

In3’s underlying purpose is solving the pressing problems of modern society, climate change mitigation, health and wealth. Investments seek “affluence without effluence,” where “effluence” is all types of waste, including wasted time and energy.

“There are companies around the globe with key pieces to this puzzle.” Daniel notes that “we only get to scale if these companies propose and fund projects that deliver clean, sustainable, circular, impact solutions.” For more, visit in3capital.net/about

There’s a “magic machine that sucks carbon out of the air, costs very little, and builds itself.”

Greta Thunberg

About

Daniel Robin

Daniel N. Robin, founder & managing partner, has more than 20 years financial, executive/board, impact investing and venture catalyst experience. Specializing in clean technology project development and investment readiness, Daniel brings diverse industry experience in clean energy, renewable resources (food/water/forestry), waste-to-value, sustainable agriculture, health/nutraceuticals, biomaterials/green chemistry, IT/fintech, and real estate/housing.

Co-founder of Renewables Investor Forum (RIF), keynote speaker and conference chair. Former adjunct professor at Monterey Institute of International Studies (MIIS, now Middlebury Institute), he and has taught entrepreneurship, business planning, impact investing, and innovation for sustainability within the top-10 ranked international MBA program in California and holds certificates in public speaking, coaching/facilitation, NeuroLinguistics (NLP Comprehensive, 1991), and Emerging Markets Credit (Moody’s Analytics, 2012).

In3 Finance Group Educational services such as key themes for presentations, workshops, webinars or retreats. Education remains an important facet of In3’s work and mission. Much of what we do is dedicated to helping build bridges of understanding, access to solutions, skillful entrepreneurship, fundraising and much more. Toward that end, as a former adjunct professor at a top-rated business school, managing partner Daniel Robin makes it a priority to offer presentations, programs and consulting services that are “just-in-time” — applied to the challenges at hand.

At In3 Group, we’ve developed a platform, programs and assessment tools that allow you to honestly evaluate where you are now, how you stack up compared to the ideal, and thus precisely estimate your chances for successful fundraising. The “onramp” to all this is called RAIN. Once you obtain your score, (or letter grade) contact us to learn more about subsequent steps, how to qualify for billions in available capital through In3 Capital Partners, schedule a private webinar or tool demonstration, or to join the next public workshop session using these tools: In3 events.

Register for CZW Virtual Meeting

Corporations, investors and experts in biogas work in silos and CZW’s meeting will help educate corporations on the benefits of RNG as a viable solution to combating climate change, adding new clean jobs and localizing supply chains.

Social Enviro Impact Roundtable, A Virtual Meeting:

Scaling Green RNG & Green Hydrogen Production February 18th

Register here.

CZW Global Sustainability Consulting Services